Fair enough: indeed, the fundamental idea behind progressive taxes is that it is fair for those who are earning significantly more should bear more of the burden.

So what's this all about?

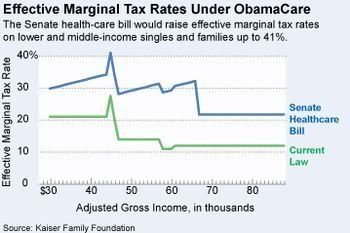

Here's the chart:

That's not a progressive tax curve: that is a regressive tax curve.

In other words, the taxes paid by those less well off are, proportionately, higher than those better off.

The exact opposite of what a progressive tax should be.

In other words, as can be seen here, the tax policy of the Obama Administration, the most liberal administration since the Carter years, is clearly and unmistakeably regressive, not progressive.

To be fair, the chart shows that the current situation is also regressive: but the cumulative effects of what the Obama Administration plans makes the situation worse, not better.

Oh, and by worse I mean this: look how the overall tax burden is set to increase massively. We're not talking a small change, a couple of points here and there: someone earning $30k/year will see their income tax increase from 20% of income to 30% of income: that's a change from $6k to $9k, meaning 10% less income. The proportional increases are particularly strong in the lower-income to middle-income brackets.

The mind boggles.

Hat tip to TaxProf.

Keine Kommentare:

Kommentar veröffentlichen